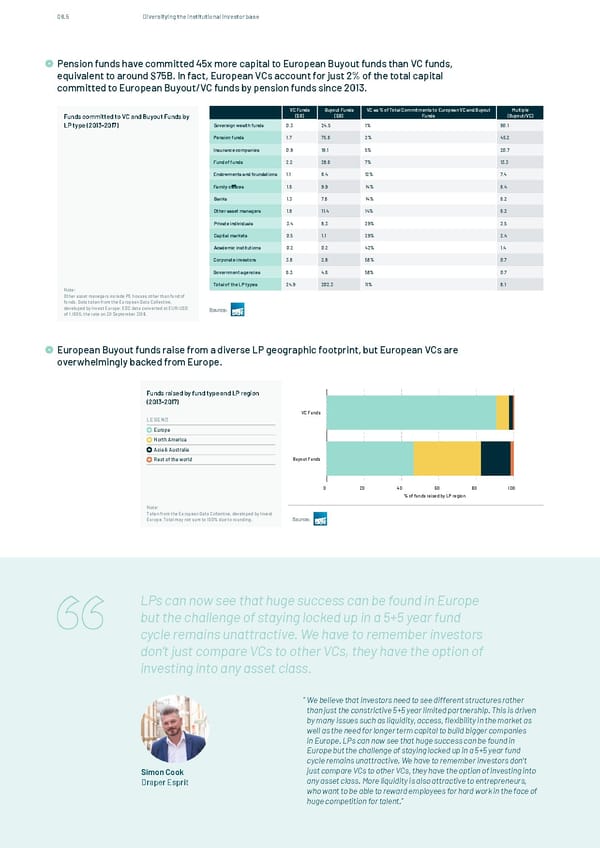

08.5 Diversifying the institutional investor base Pension funds have committed 45x more capital to European Buyout funds than VC funds, Pension funds have committed 45x more capital to European Buyout funds than VC funds, equivalent to around Pension funds have committed 45x more capital to European Buyout funds than VC funds, equivalent to around equivalent to around $75B. In fact, European VCs account for just 2% of the total capital $75B. In fact, European VCs account for just 2% of the total capital committed to European Buyout/VC funds by $75B. In fact, European VCs account for just 2% of the total capital committed to European Buyout/VC funds by committed to European Buyout/VC funds by pension funds since 2013. pension funds since 2013. pension funds since 2013. VC Funds Buyout Funds VC as % of Total Commitments to European VC and Buyout Multiple VC Funds Buyout Funds VC as % of Total Commitments to European VC and Buyout Multiple ($B) ($B) Funds (Buyout/VC) Funds committed to VC and Buyout Funds by ($B) ($B) Funds (Buyout/VC) Funds committed to VC and Buyout Funds by Sovereign wealth funds 0.3 24.5 1% 90.1 LP type (2013-2017) Sovereign wealth funds 0.3 24.5 1% 90.1 LP type (2013-2017) Pension funds 1.7 75.6 2% 45.2 Pension funds 1.7 75.6 2% 45.2 Insurance companies 0.9 19.1 5% 20.7 Insurance companies 0.9 19.1 5% 20.7 Fund of funds 2.2 28.6 7% 13.3 Fund of funds 2.2 28.6 7% 13.3 Endowments and foundations 1.1 8.4 12% 7.4 Endowments and foundations 1.1 8.4 12% 7.4 Family o ces 1.6 9.9 14% 6.4 Family o ces 1.6 9.9 14% 6.4 Banks 1.3 7.8 14% 6.2 Banks 1.3 7.8 14% 6.2 Other asset managers 1.8 11.4 14% 6.2 Other asset managers 1.8 11.4 14% 6.2 Private individuals 3.4 8.3 29% 2.5 Private individuals 3.4 8.3 29% 2.5 Capital markets 0.5 1.1 29% 2.4 Capital markets 0.5 1.1 29% 2.4 Academic institutions 0.2 0.2 42% 1.4 Academic institutions 0.2 0.2 42% 1.4 Corporate investors 3.8 2.8 58% 0.7 Corporate investors 3.8 2.8 58% 0.7 Government agencies 6.3 4.6 58% 0.7 Note: Government agencies 6.3 4.6 58% 0.7 Other asset managers include PE houses other than fund of Total of the LP types 24.9 202.3 11% 8.1 Note:funds. Data taken from the European Data Collective, Total of the LP types 24.9 202.3 11% 8.1 Other asset managers include PE houses other than fund of developed by Invest Europe. EDC data converted at EUR:USD funds. Data taken from the European Data Collective, of 1.1605, the rate on 30 September 2018. developed by Invest Europe. EDC data converted at EUR:USD of 1.1605, the rate on 30 September 2018. European Buyout funds raise from a diverse LP geographic European Buyout funds raise from a diverse LP geographic footprint, but European VCs are footprint, but European VCs are overwhelmingly backed from overwhelmingly backed from Europe. Europe. Funds raised by fund type and LP region (2013-2017) VC Funds LEGEND Europe North America Asia & Australia Rest of the world Buyout Funds 0 20 40 60 80 100 % of funds raised by LP region Note: Taken from the European Data Collective, developed by Invest Europe. Total may not sum to 100% due to rounding. LPs can now see that huge success can be found in Europe but the challenge of staying locked up in a 5+5 year fund cycle remains unattractive. We have to remember investors don’t just compare VCs to other VCs, they have the option of investing into any asset class. “ We believe that investors need to see different structures rather than just the constrictive 5+5 year limited partnership. This is driven by many issues such as liquidity, access, flexibility in the market as well as the need for longer term capital to build bigger companies in Europe. LPs can now see that huge success can be found in Europe but the challenge of staying locked up in a 5+5 year fund cycle remains unattractive. We have to remember investors don’t Simon Cook just compare VCs to other VCs, they have the option of investing into Draper Esprit any asset class. More liquidity is also attractive to entrepreneurs, who want to be able to reward employees for hard work in the face of huge competition for talent.” 125 In Partnership with & www.thestateofeuropeantech.com

The State of European Tech Page 124 Page 126

The State of European Tech Page 124 Page 126