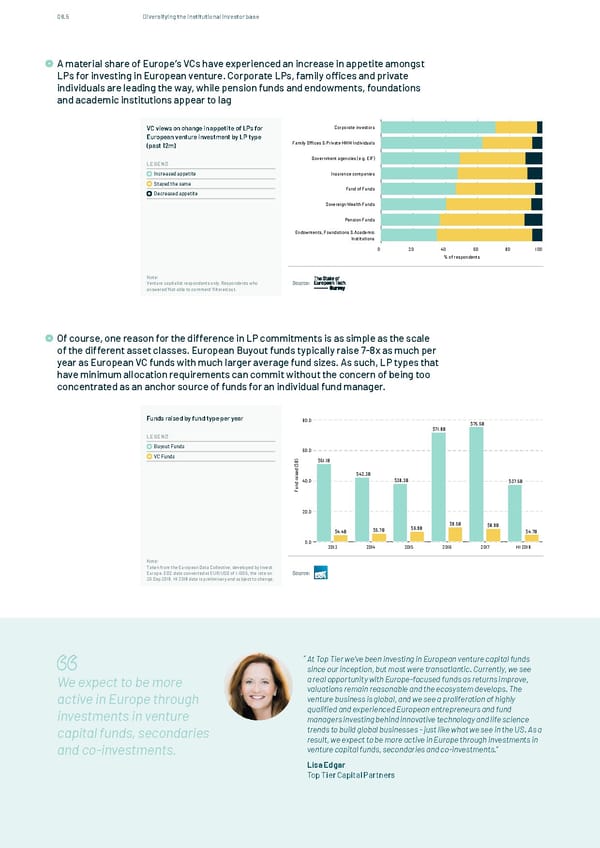

08.5 Diversifying the institutional investor base A material share of Europe’s VCs have experienced an increase in appetite amongst LPs for investing in European venture. Corporate LPs, family offices and private A material share of Europe's VCs have experienced an increase in appetite amongst LPs for investing in European individuals are leading the way, while pension funds and endowments, foundations venture. Corporate LPs, family o�ces and private individuals are leading the way, while pension funds and and academic institutions appear to lag endowments, foundations and academic institutions appear to lag VC views on change in appetite of LPs for Corporate investors European venture investment by LP type (past 12m) Family Offices & Private HNW Individuals Government agencies (e.g. EIF) LEGEND Increased appetite Insurance companies Stayed the same Fund of Funds Decreased appetite Sovereign Wealth Funds Pension Funds Endowments, Foundations & Academic Institutions 0 20 40 60 80 100 % of respondents Note: Venture capitalist respondents only. Respondents who Source: answered 'Not able to comment' �ltered out. Of course, one reason for the difference in LP commitments is as simple as the scale of the different asset classes. European Buyout funds typically raise 7-8x as much per Of course, one reason for the difference in LP commitments is as simple as the scale of the different asset year as European VC funds with much larger average fund sizes. As such, LP types that classes. European Buyout funds typically raise 7-8x as much per year as European VC funds with much larger have minimum allocation requirements can commit without the concern of being too average fund sizes. As such, LP types that have minimum allocation requirements can commit without the concentrated as an anchor source of funds for an individual fund manager. concern of being too concentrated as an anchor source of funds for an individual fund manager. Funds raised by fund type per year 80.0 $75.5B $71.8B LEGEND Buyout Funds 60.0 VC Funds ) B $51.1B $ ( d e s $42.3B i a r 40.0 $38.3B $37.5B d n u F 20.0 $9.5B $8.9B $4.4B $5.7B $6.9B $4.7B 0.0 2013 2014 2015 2016 2017 H1 2018 Note: Taken from the European Data Collective, developed by Invest Europe. EDC data converted at EUR:USD of 1.1605, the rate on Source: 30 Sep 2018. H1 2018 data is preliminary and subject to change. “ At Top Tier we’ve been investing in European venture capital funds since our inception, but most were transatlantic. Currently, we see We expect to be more a real opportunity with Europe-focused funds as returns improve, valuations remain reasonable and the ecosystem develops. The active in Europe through venture business is global, and we see a proliferation of highly investments in venture qualified and experienced European entrepreneurs and fund managers investing behind innovative technology and life science capital funds, secondaries trends to build global businesses - just like what we see in the US. As a result, we expect to be more active in Europe through investments in and co-investments. venture capital funds, secondaries and co-investments.” Lisa Edgar Top Tier Capital Partners 124 In Partnership with & www.thestateofeuropeantech.com www.thestateofeuropeantech.com

The State of European Tech Page 123 Page 125

The State of European Tech Page 123 Page 125