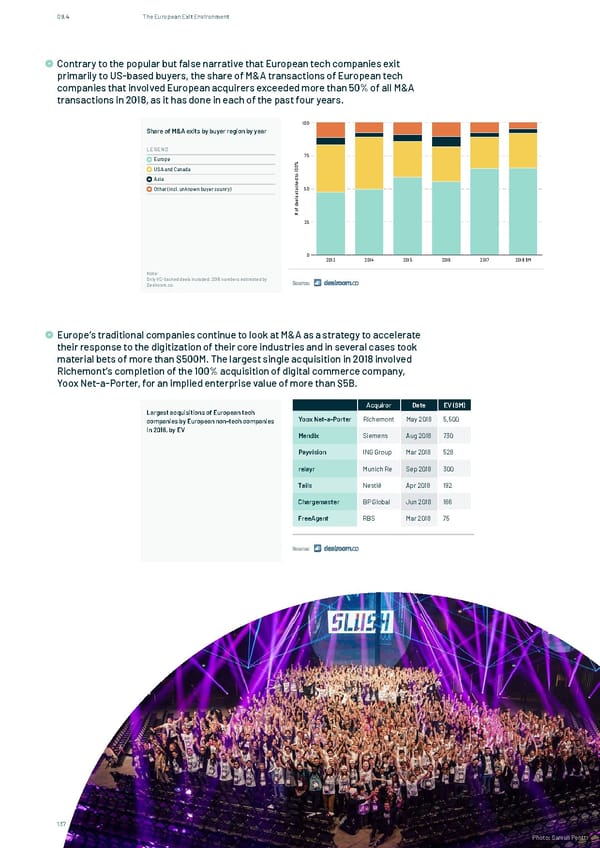

09.4 The European Exit Environment Contrary to the popular but false narrative that European tech companies exit primarily to US-based buyers, the share of M&A transactions of European tech Contrary to the popular, but false narrative that European tech companies exit primarily to US-based buyers, the companies that involved European acquirers exceeded more than 50% of all M&A share of M&A transactions of European tech companies that involved European acquirers exceeded more than transactions in 2018, as it has done in each of the past four years. 50% of all M&A transactions in 2018, as it has done in each of the past four years. 100 Share of M&A exits by buyer region by year LEGEND Europe 75 % 0 USA and Canada 0 1 o t Asia d e k c 50 Other (incl. unknown buyer counry) a t s s l a e d f o # 25 0 2013 2014 2015 2016 2017 2018 9M Note: Only VC-backed deals included. 2018 numbers estimated by Source: Dealroom.co. Europe’s traditional companies continue to look at M&A as a strategy to accelerate Europe's traditional companies continue to look at M&A as a strategy to accelerate their response to the their response to the digitization of their core industries and in several cases took Europe's traditional companies continue to look at M&A as a strategy to accelerate their response to the digitization of their core industries and in several cases took material bets of more than $500M. The largest single material bets of more than $500M. The largest single acquisition in 2018 involved digitization of their core industries and in several cases took material bets of more than $500M. The largest single acquisition in 2018 involved Richemont's completion of the 100% acquisition of digital commerce company, Yoox Richemont’s completion of the 100% acquisition of digital commerce company, acquisition in 2018 involved Richemont's completion of the 100% acquisition of digital commerce company, Yoox Net-a-Porter, for an implied enterprise value of $6B. Yoox Net-a-Porter, for an implied enterprise value of more than $5B. Net-a-Porter, for an implied enterprise value of $6B. Acquiror Date EV ($M) Acquiror Date EV ($M) Largest acquisitions of European tech Yoox Net-a-Porter Richemont May 2018 5,500 Largest acquisitions of European tech Yoox Net-a-Porter Richemont May 2018 5,500 companies by European non-tech companies companies by European non-tech companies Mendix Siemens Aug 2018 730 in 2018, by EV Mendix Siemens Aug 2018 730 in 2018, by EV Payvision ING Group Mar 2018 528 Payvision ING Group Mar 2018 528 relayr Munich Re Sep 2018 300 Tails Nestlé Apr 2018 192 relayr Munich Re Sep 2018 300 Chargemaster BP Global Jun 2018 166 Tails Nestlé Apr 2018 192 FreeAgent RBS Mar 2018 75 Chargemaster BP Global Jun 2018 166 Source: FreeAgent RBS Mar 2018 75 Source: 137 In Partnership with & www.thestateofeuropeantech.com Photo: Samuli Pentti

The State of European Tech Page 136 Page 138

The State of European Tech Page 136 Page 138