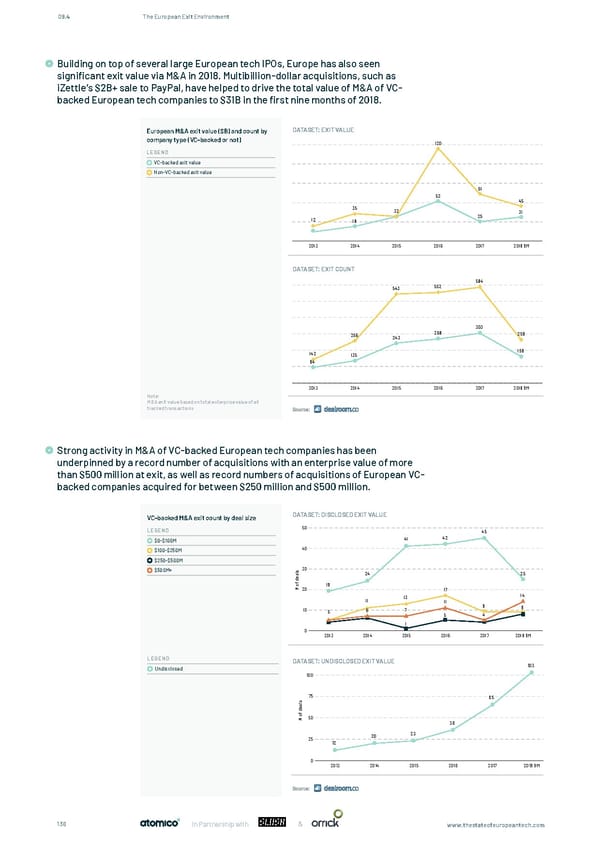

09.4 The European Exit Environment Building on top of several large European tech IPOs, Europe has also seen significant exit value via M&A in 2018. Multibillion-dollar acquisitions, such as Building on top of several large European tech IPOs, Europe has also seen signi cant exit value via M&A in 2018. iZettle’s $2B+ sale to PayPal, have helped to drive the total value of M&A of VC- Multi-billion acquisitions, such as iZettle's $2B+ sale to PayPal, have helped to drive the total value of M&A of VC- backed European tech companies to $31B in the first nine months of 2018. backed European tech companies to $31B in the rst nine months of 2018. European M&A exit value ($B) and count by DATASET: EXIT VALUE company type (VC-backed or not) 120 LEGEND VC-backed exit value Non-VC-backed exit value 61 52 45 35 32 31 Building on top of several large European tech IPOs, Europe has also seen signi cant exit value via M&A in 2018. 12 25 19 Multi-billion acquisitions, such as iZettle's $2B+ sale to PayPal, have helped to drive the total value of M&A of VC- backed European tech companies to $31B in the rst nine months of 2018. 2013 2014 2015 2016 2017 2018 9M European M&A exit value ($B) and count by company type (VC-backed or not) DATASET: EXIT COUNT DATASET: EXIT COUNT 584 543 552 LEGEND VC-backed exit count Non-VC-backed exit count 303 256 268 259 243 142 135 159 94 2013 2014 2015 2016 2017 2018 9M Note: Note: M&A exit value based on total enterprise value of all M&A exit value based on total enterprise value of all tracked tracked transactions transactions Strong activity in M&A of VC-backed European tech companies has been underpinned by a record number of acquisitions with an enterprise value of more A strong for M&A of VC-backed European tech companies has been underpinned by a record number of than $500 million at exit, as well as record numbers of acquisitions of European VC- acquisitions with an enterprise value of more than $500M at exit, as well as record numbers of acquisitions of backed companies acquired for between $250 million and $500 million. European VC-backed companies acquired for between $250M and $500M. VC-backed M&A exit count by deal size DATASET: DISCLOSED EXIT VALUE LEGEND 50 45 $0-$100M 41 42 $100-$250M 40 $250-$500M $500M+ s 30 l 24 25 a e d f 19 o # 20 17 13 14 11 11 10 7 9 9 5 6 5 4 A strong for M&A of VC-backed European tech companies has been underpinned by a record number of 1 acquisitions with an enterprise value of more than $500M at exit, as well as record numbers of acquisitions of 0 2013 2014 2015 2016 2017 2018 9M European VC-backed companies acquired for between $250M and $500M. LEGEND DATASET: UNDISCLOSED EXIT VALUE Undisclosed 103 100 s 75 65 l a e d f o 50 # 36 20 23 25 12 0 2013 2014 2015 2016 2017 2018 9M 136 In Partnership with & www.thestateofeuropeantech.com

The State of European Tech Page 135 Page 137

The State of European Tech Page 135 Page 137