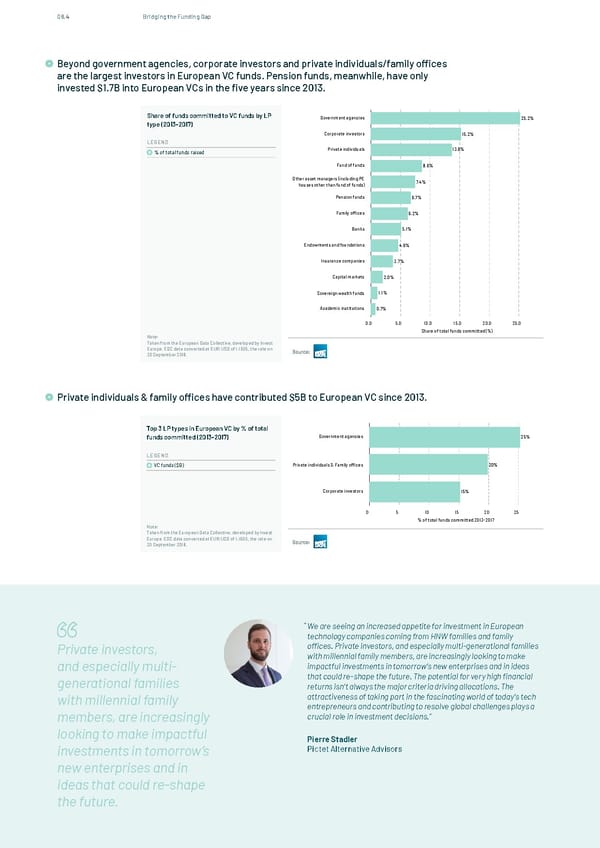

08.4 Bridging the Funding Gap Beyond government agencies, corporate investors and private individuals/family offices Beyond government agencies, corporate investors and private individuals/family o ces are the largest investors are the largest investors in European VC funds. Pension funds, meanwhile, have only in European VC funds. Pension funds, meanwhile, have only invested $2.4 billion into European VCs in the ve invested $1.7B into European VCs in the five years since 2013. years since 2013. Share of funds committed to VC funds by LP Government agencies 25.2% type (2013-2017) Corporate investors 15.2% LEGEND % of total funds raised Private individuals 13.6% Fund of funds 8.6% Other asset managers (including PE 7.4% houses other than fund of funds) Pension funds 6.7% Family offices 6.2% Banks 5.1% Endowments and foundations 4.6% Insurance companies 3.7% Capital markets 2.0% Sovereign wealth funds 1.1% Academic institutions 0.7% 0.0 5.0 10.0 15.0 20.0 25.0 Share of total funds committed (%) Note: Taken from the European Data Collective, developed by Invest Europe. EDC data converted at EUR:USD of 1.1605, the rate on 30 September 2018. European tech growth and success has not gone unnoticed by family o ces and high net-worth individuals (HNWs). Over the last ve years, they have collectively invested over $5 billion in European venture capital funds. Private individuals & family offices have contributed $5B to European VC since 2013. Only government agencies have invested more in European VC in that same period. Top 3 LP types in European VC by % of total funds committed (2013-2017) Government agencies 25% LEGEND VC funds ($B) Private individuals & Family offices 20% Corporate investors 15% 0 5 10 15 20 25 % of total funds committed 2013-2017 Note: Taken from the European Data Collective, developed by Invest Europe. EDC data converted at EUR:USD of 1.1605, the rate on 30 September 2018. “ We are seeing an increased appetite for investment in European technology companies coming from HNW families and family Private investors, offices. Private investors, and especially multi-generational families with millennial family members, are increasingly looking to make and especially multi- impactful investments in tomorrow’s new enterprises and in ideas generational families that could re-shape the future. The potential for very high financial returns isn’t always the major criteria driving allocations. The with millennial family attractiveness of taking part in the fascinating world of today’s tech entrepreneurs and contributing to resolve global challenges plays a members, are increasingly crucial role in investment decisions.” looking to make impactful Pierre Stadler investments in tomorrow’s Pictet Alternative Advisors new enterprises and in ideas that could re-shape the future. 121 In Partnership with & www.thestateofeuropeantech.com

The State of European Tech Page 120 Page 122

The State of European Tech Page 120 Page 122