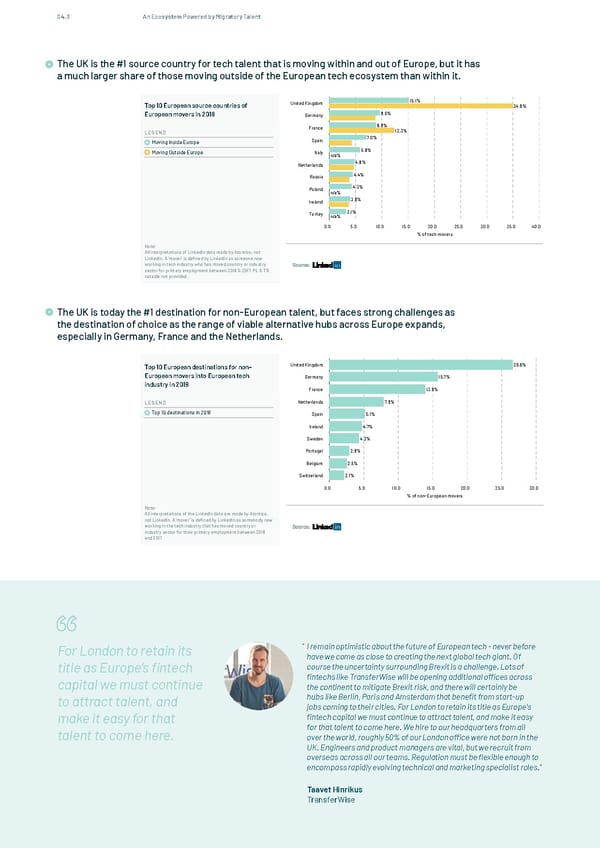

04.3 An Ecosystem Powered by Migratory Talent The UK is the #1 source country for tech talent that is moving within and out of Europe, but it has The UK is the #1 source country for tech talent that is moving within and out of Europe, but it has a much larger a much larger share of those moving outside of the European tech ecosystem than within it. share of those moving outside of the European tech ecosystem than within it United Kingdom 15.1% Top 10 European source countries of 34.9% European movers in 2018 Germany 9.6% France 8.9% LEGEND 12.3% Spain 7.0% Moving Inside Europe Moving Outside Europe Italy 5.8% n/a% Netherlands 4.8% Russia 4.4% Poland 4.3% n/a% Ireland 3.9% Turkey 3.1% n/a% 0.0 5.0 10.0 15.0 20.0 25.0 30.0 35.0 40.0 % of tech movers Note: All interpretations of LinkedIn data made by Atomico, not LinkedIn. A 'mover' is deïned by LinkedIn as someone now Source: working in tech industry who has moved country or industry sector for primary employment between 2018 & 2017. PL & TR outside not provided. The UK is today the #1 destination for non-European talent, but faces strong challenges as The UK is today the #1 destination for non-European talent, but faces strong challenges as the destination of the destination of choice as the range of viable alternative hubs across Europe expands, choice as the range of viable alternative hubs across Europe expands, especially in Germany, France and the especially in Germany, France and the Netherlands. Netherlands Top 10 European destinations for non- United Kingdom 26.6% European movers into European tech Germany 15.7% industry in 2018 France 13.9% LEGEND Netherlands 7.9% Top 10 destinations in 2018 Spain 5.1% Ireland 4.7% Sweden 4.3% Portugal 2.9% Belgium 2.5% Switzerland 2.1% 0.0 5.0 10.0 15.0 20.0 25.0 30.0 % of non-European movers Note: All interpretations of the LinkedIn data are made by Atomico, not LinkedIn. A 'mover' is deïned by LinkedIn as somebody now Source: working in the tech industry that has moved country or industry sector for their primary employment between 2018 and 2017. For London to retain its “ I remain optimistic about the future of European tech - never before have we come as close to creating the next global tech giant. Of title as Europe’s fintech course the uncertainty surrounding Brexit is a challenge. Lots of capital we must continue fintechs like TransferWise will be opening additional offices across the continent to mitigate Brexit risk, and there will certainly be to attract talent, and hubs like Berlin, Paris and Amsterdam that benefit from start-up jobs coming to their cities. For London to retain its title as Europe’s make it easy for that fintech capital we must continue to attract talent, and make it easy for that talent to come here. We hire to our headquarters from all talent to come here. over the world, roughly 50% of our London office were not born in the UK. Engineers and product managers are vital, but we recruit from overseas across all our teams. Regulation must be flexible enough to encompass rapidly evolving technical and marketing specialist roles.“ Taavet Hinrikus TransferWise & 53 In Partnership with www.thestateofeuropeantech.com

The State of European Tech Page 52 Page 54

The State of European Tech Page 52 Page 54