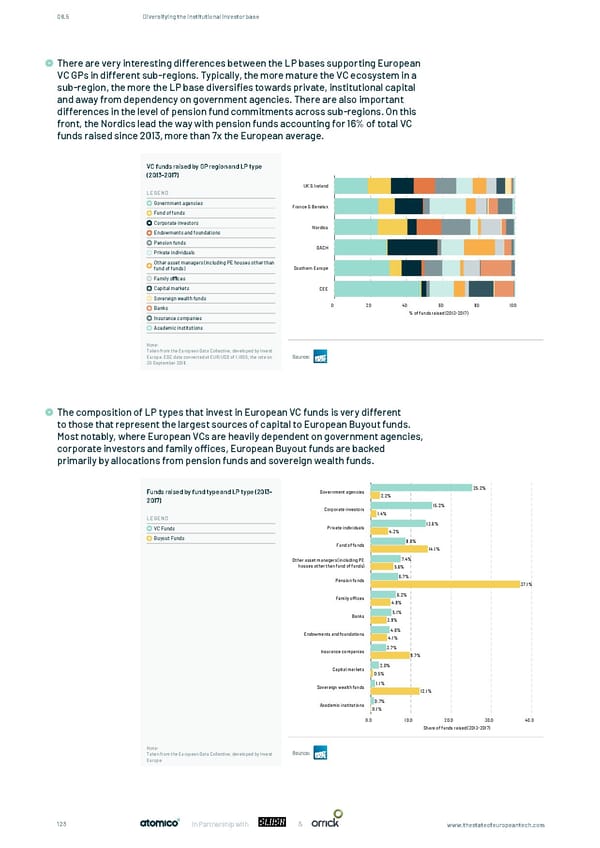

08.5 Diversifying the institutional investor base There are very interesting differences between the LP bases supporting European VC GPs in different sub-regions. Typically, the more mature the VC ecosystem in a sub-region, the more the LP base diversifies towards private, institutional capital There are very interesting differences between the LP bases supporting European VC GPs in different sub-region. and away from dependency on government agencies. There are also important Typically, the more mature the VC ecosystem in a sub-region, the more the LP base diversi es towards private, differences in the level of pension fund commitments across sub-regions. On this institutional capital and away from dependency on government agencies. There are also important differences in front, the Nordics lead the way with pension funds accounting for 16% of total VC the level of pension fund commitments across sub-regions. On this front, the Nordics lead the way with pension funds raised since 2013, more than 7x the European average. funds accounting for 16% of total VC funds raised since 2013, more than 7x the European average. VC funds raised by GP region and LP type (2013-2017) UK & Ireland LEGEND Government agencies France & Benelux Fund of funds Corporate investors Nordics Endowments and foundations Pension funds DACH Private individuals Other asset managers (including PE houses other than fund of funds) Southern Europe Family o ces Capital markets CEE Sovereign wealth funds Banks 0 20 40 60 80 100 % of funds raised (2013-2017) Insurance companies Academic institutions Note: Taken from the European Data Collective, developed by Invest Europe. EDC data converted at EUR:USD of 1.1605, the rate on Source: 30 September 2018. The composition of LP types that invest in European VC funds is very different to those that represent the largest sources of capital to European Buyout funds. The composition of LP types that invest in European VC funds is very different to those that represent the largest Most notably, where European VCs are heavily dependent on government agencies, sources of capital to European Buyout funds. Most notably, where European VCs are heavily dependent on corporate investors and family offices, European Buyout funds are backed government agencies, corporate investors and family oíces, European Buyout funds are backed primarily by primarily by allocations from pension funds and sovereign wealth funds. allocations from pension funds and sovereign wealth funds. Funds raised by fund type and LP type (2013- Government agencies 25.2% 2017) 2.2% Corporate investors 15.2% 1.4% LEGEND Private individuals 13.6% VC Funds 4.3% Buyout Funds 8.6% Fund of funds 14.1% Other asset managers (including PE 7.4% houses other than fund of funds) 5.6% Pension funds 6.7% 37.1% Family offices 6.2% 4.9% Banks 5.1% 3.9% Endowments and foundations 4.6% 4.1% Insurance companies 3.7% 9.7% Capital markets 2.0% 0.5% Sovereign wealth funds 1.1% 12.1% Academic institutions 0.7% 0.1% 0.0 10.0 20.0 30.0 40.0 Share of funds raised (2013-2017) Note: Taken from the European Data Collective, developed by Invest Source: Europe. 123 In Partnership with & www.thestateofeuropeantech.com

The State of European Tech Page 122 Page 124

The State of European Tech Page 122 Page 124