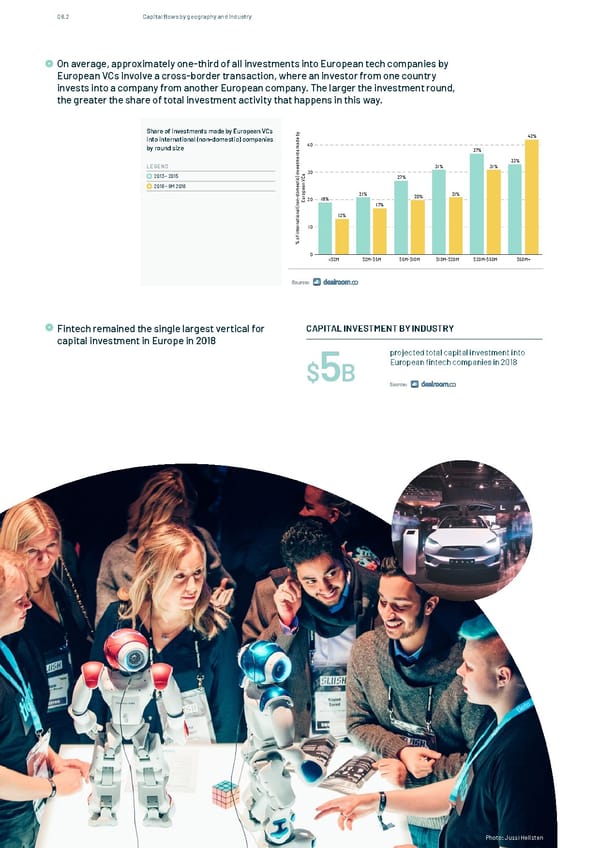

08.2 Capital flows by geography and industry On average, approximately one-third of all investments into European tech companies by On average, approximately one-third of all investments into European tech companies by European VCs involve a European VCs involve a cross-border transaction, where an investor from one country cross-border transaction, where an investor from one country invests into a company from another European invests into a company from another European company. The larger the investment round, company. The larger the investment round, the greater the share of total investment activity that happens in this the greater the share of total investment activity that happens in this way. way. Share of investments made by European VCs y b 42% into international (non-domestic) companies e d 40 ma by round size 37% s t n me 33% t LEGEND s 31% 31% e v n 30 i s 2013 - 2015 ) C 27% c i V t s n 2016 - 9M 2018 mea o pe d o 21% 21% - r 20% n u20 19% o E n 17% ( l a n o 13% i t a n r 10 e t n i f o % 0 <$2M $2M-$5M $5M-$10M $10M-$20M $20M-$50M $50M+ Source: Fintech remained the single largest vertical for CAPITAL INVESTMENT BY INDUSTRY capital investment in Europe in 2018 projected total capital investment into $ B European fintech companies in 2018 5 110 In Partnership with & www.thestateofeuropeantech.com Photo: Jussi Hellsten

The State of European Tech Page 109 Page 111

The State of European Tech Page 109 Page 111