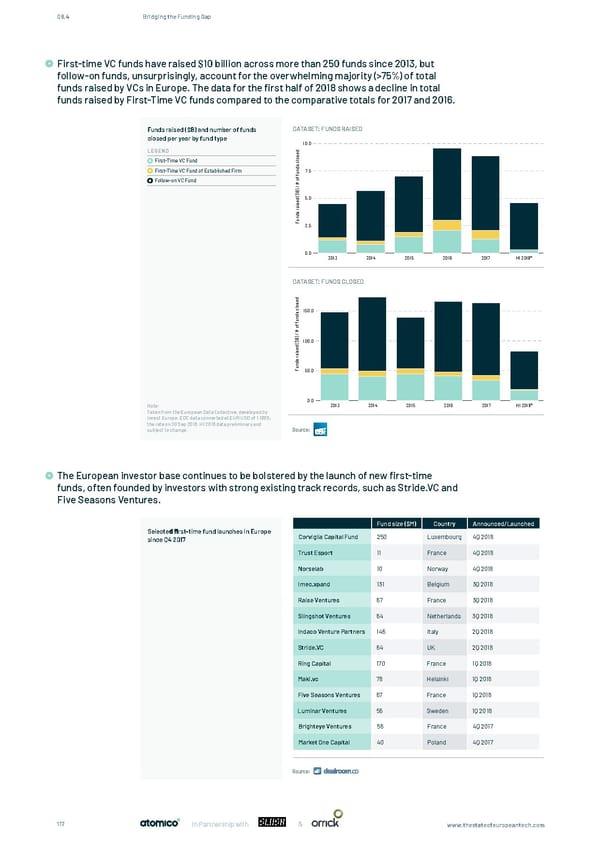

08.4 Bridging the Funding Gap First-time VC funds have raised $10 billion across more than 250 funds since 2013, but First-time VC funds have raised $10 billion across more than 250 funds since 2013, but follow-on funds, follow-on funds, unsurprisingly, account for the overwhelming majority (>75%) of total unsurprisingly, account for the overwhelming majority (>75%) of total funds raised by VCs in Europe. The data for funds raised by VCs in Europe. The data for the first half of 2018 shows a decline in total the rst half of 2018 shows a decline in total funds raised by First-Time VC funds compared to the comparative funds raised by First-Time VC funds compared to the comparative totals for 2017 and 2016. totals for 2017 and 2016. Funds raised ($B) and number of funds DATASET: FUNDS RAISED closed per year by fund type 10.0 LEGEND d e s o First-Time VC Fund l c s d First-Time VC Fund of Established Firm n 7.5 u f f o Follow-on VC Fund # / ) B $ ( 5.0 d e s i a r s d n u First-time VC funds have raised $10 billion across more than 250 funds since 2013, but follow-on funds, F 2.5 unsurprisingly, account for the overwhelming majority (>75%) of total funds raised by VCs in Europe. The data for the rst half of 2018 shows a decline in total funds raised by First-Time VC funds compared to the comparative totals for 2017 and 2016. 0.0 2013 2014 2015 2016 2017 H1 2018* Funds raised ($B) and number of funds DATASET: FUNDS CLOSED closed per year by fund type DATASET: FUNDS CLOSED d e s o l LEGEND c 150.0 s d First-Time VC Fund n u f f o First-Time VC Fund of Established Firm # / ) Follow-on VC Fund B100.0 $ ( d e s i a r s d n u F 50.0 0.0 Note: 2013 2014 2015 2016 2017 H1 2018* Taken from the European Data Collective, developed by Invest Europe. EDC data converted at EUR:USD of 1.1605, Note: the rate on 30 Sep 2018. H1 2018 data preliminary and Taken from the European Data Collective, developed by Invest subject to change. Source: Europe. EDC data converted at EUR:USD of 1.1605, the rate on 30 Sep 2018. H1 2018 data preliminary and subject to change. The European investor base continues to be bolstered by the launch of new first-time funds, often founded by investors with strong existing track records, such as Stride.VC and The European investor base continues to be bolstered by the launch of new rst-time funds, often founded by The European investor base continues to be bolstered by the launch of new rst-time funds, often founded by Five Seasons Ventures. investors with strong existing track records, such as Stride.VC and Five Seasons Ventures investors with strong existing track records, such as Stride.VC and Five Seasons Ventures Fund size ($M) Country Announced/Launched Fund size ($M) Country Announced/Launched Selecte rst-time fund launches in Europe Corviglia Capital Fund 250 Luxembourg 4Q 2018 Selecte rst-time fund launches in Europe Corviglia Capital Fund 250 Luxembourg 4Q 2018 since Q4 2017 since Q4 2017 Trust Esport 11 France 4Q 2018 Trust Esport 11 France 4Q 2018 Norselab 10 Norway 4Q 2018 Norselab 10 Norway 4Q 2018 Imec.xpand 131 Belgium 3Q 2018 Imec.xpand 131 Belgium 3Q 2018 Raise Ventures 67 France 3Q 2018 Slingshot Ventures 64 Netherlands 3Q 2018 Raise Ventures 67 France 3Q 2018 Indaco Venture Partners 146 Italy 2Q 2018 Slingshot Ventures 64 Netherlands 3Q 2018 Stride.VC 64 UK 2Q 2018 Indaco Venture Partners 146 Italy 2Q 2018 Ring Capital 170 France 1Q 2018 Stride.VC 64 UK 2Q 2018 Maki.vc 78 Helsinki 1Q 2018 Five Seasons Ventures 67 France 1Q 2018 Ring Capital 170 France 1Q 2018 Luminar Ventures 56 Sweden 1Q 2018 Maki.vc 78 Helsinki 1Q 2018 Brighteye Ventures 56 France 4Q 2017 Five Seasons Ventures 67 France 1Q 2018 Market One Capital 40 Poland 4Q 2017 Luminar Ventures 56 Sweden 1Q 2018 Source: Brighteye Ventures 56 France 4Q 2017 Market One Capital 40 Poland 4Q 2017 Source: 117 In Partnership with & www.thestateofeuropeantech.com

The State of European Tech Page 116 Page 118

The State of European Tech Page 116 Page 118