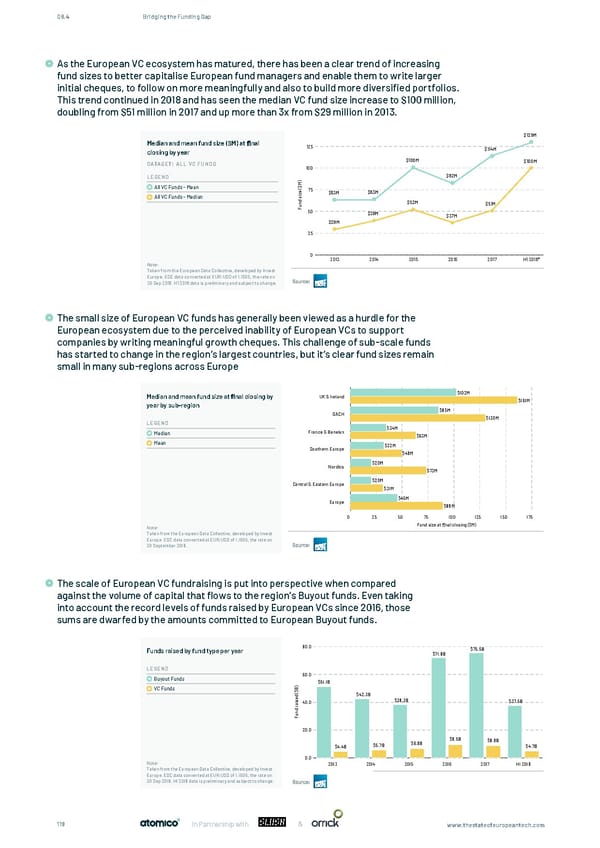

08.4 Bridging the Funding Gap As the European VC ecosystem has matured, there has been a clear trend of increasing fund sizes to better capitalise European fund managers and enable them to write larger As the European VC ecosystem has matured, there has been a clear trend of increasing fund sizes to better initial cheques, to follow on more meaningfully and also to build more diversified portfolios. capitalise European fund managers and enable them to write larger initial cheques, to follow on more meaningfully This trend continued in 2018 and has seen the median VC fund size increase to $100 million, and also to build more diversi ed portfolios. This trend continued in 2018 and has seen the median VC fund size doubling from $51 million in 2017 and up more than 3x from $29 million in 2013. increase to $100 million, doubling from $51 million in 2017 and up more than 3x from $29 million in 2013. $129M Median and mean fund size ($M) at nal 125 closing by year $114M DATASET: ALL VC FUNDS $100M $100M 100 LEGEND ) $82M M All VC Funds - Mean $ ( 75 e $63M $63M z i All VC Funds - Median s d $52M n $51M u F 50 $39M $37M $29M 25 0 2013 2014 2015 2016 2017 H1 2018* Note: Taken from the European Data Collective, developed by Invest Europe. EDC data converted at EUR:USD of 1.1605, the rate on 30 Sep 2018. H1 2018 data is preliminary and subject to change. Source: The small size of European VC funds has generally been viewed as a hurdle for the European ecosystem due to the perceived inability of European VCs to support The small size of European VC funds has generally been viewed as a hurdle for the European ecosystem due to the companies by writing meaningful growth cheques. This challenge of sub-scale funds perceived inability of European VCs to support companies by writing meaningful growth cheques. This challenge has started to change in the region’s largest countries, but it’s clear fund sizes remain of sub-scale funds has started to change in the region's largest countries, but it's clear fund sizes remain small in small in many sub-regions across Europe many sub-regions across Europe. Median and mean fund size at nal closing by UK & Ireland $102M year by sub-region $161M DACH $85M $130M LEGEND France & Benelux $34M Median $63M Mean $32M Southern Europe $49M Nordics $20M $73M Central & Eastern Europe $20M $31M Europe $45M $89M 0 25 50 75 100 125 150 175 Note: Fund size at nal closing ($M) Taken from the European Data Collective, developed by Invest Europe. EDC data converted at EUR:USD of 1.1605, the rate on 30 September 2018. Source: The scale of European VC fundraising is put into perspective when compared Of course, one reason for the difference in LP commitments is as simple as the scale of the different asset against the volume of capital that flows to the region’s Buyout funds. Even taking classes. European Buyout funds typically raise 7-8x as much per year as European VC funds with much larger into account the record levels of funds raised by European VCs since 2016, those average fund sizes. As such, LP types that have minimum allocation requirements can commit without the sums are dwarfed by the amounts committed to European Buyout funds. concern of being too concentrated as an anchor source of funds for an individual fund manager. Funds raised by fund type per year 80.0 $75.5B $71.8B LEGEND Buyout Funds 60.0 ) $51.1B VC Funds B $ ( $42.3B d e $38.3B s $37.5B i 40.0 a r d n u F 20.0 $9.5B $8.9B $4.4B $5.7B $6.9B $4.7B 0.0 Note: 2013 2014 2015 2016 2017 H1 2018 Taken from the European Data Collective, developed by Invest Europe. EDC data converted at EUR:USD of 1.1605, the rate on 30 Sep 2018. H1 2018 data is preliminary and subject to change. Source: & 119 In Partnership with www.thestateofeuropeantech.com

The State of European Tech Page 118 Page 120

The State of European Tech Page 118 Page 120